Mastering Profit and Loss Statements as a Sole Proprietor: Beyond the Basics

Running a sole proprietorship means wearing many hats. One of the most powerful tools at your disposal is the Profit and Loss (P&L) statement.

Mastering Profit and Loss Statements as a Sole Proprietor: Beyond the Basics

Most business owners know they need a Profit and Loss (P&L) statement, but few realize how much insight it can provide when you dig beneath the surface. Let’s go beyond the basics and explore how to use your P&L as a strategic tool for growth, efficiency, and long-term success.

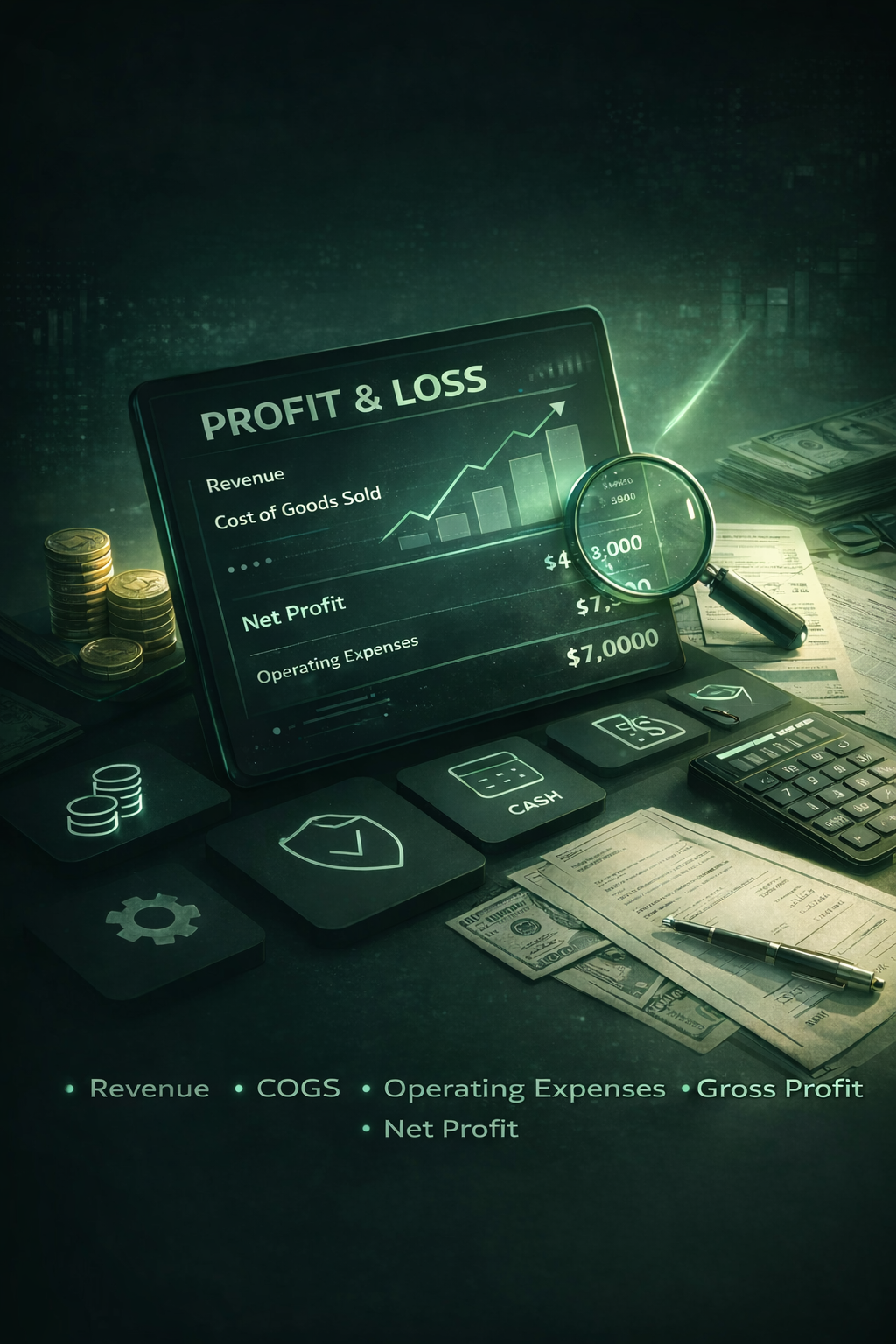

The Anatomy of a P&L: What Each Line Really Means

Revenue: Not All Income Is Equal

Break Down Revenue Streams

Separate your income by product, service, or client type. This allows you to identify which offerings are most profitable and which may need adjustment.

Recurring vs. One-Time Sales

Recurring revenue provides stability and predictability, making it far more valuable for planning, forecasting, and long-term valuation than one-off sales.

Cost of Goods Sold (COGS): The True Cost of Doing Business

Direct vs. Indirect Costs

Only include costs directly tied to delivering your product or service (materials, subcontractors, direct labor). Overhead expenses belong elsewhere.

COGS Analysis

If COGS is increasing faster than revenue, investigate supplier pricing, inefficiencies, or wasted resources.

Gross Profit: Your First Profit Checkpoint

Gross Margin Percentage

Calculate:

Gross Profit ÷ Revenue × 100

Compare this figure to industry benchmarks to assess efficiency.

Improving Gross Margin

Consider renegotiating supplier rates, refining pricing strategies, or streamlining delivery processes.

Operating Expenses: Where Profits Disappear

Fixed vs. Variable Expenses

Fixed costs (rent, insurance) remain stable, while variable costs (marketing, utilities) fluctuate. Understanding the difference supports smarter budgeting.

Expense Ratios

Track what percentage of revenue goes to each expense category. High marketing costs may be justified if they drive growth, while excessive administrative costs may signal inefficiency.

Net Profit: The Bottom Line

Net Margin

Calculate:

Net Profit ÷ Revenue × 100

This is your true measure of profitability.

Owner’s Draw

For sole proprietors, compensation typically comes from net profit. Plan owner’s draws carefully to avoid cash flow strain.

Advanced P&L Analysis: Turning Numbers Into Strategy

1. Trend Analysis

Month-over-Month & Year-over-Year

Track each line item consistently to identify seasonality, expense creep, or growth patterns.

Rolling Averages

Use rolling averages to smooth short-term fluctuations and reveal underlying trends.

2. Ratio Analysis

Operating Expense Ratio

Total Operating Expenses ÷ Revenue

Lower is generally better, but too low may indicate underinvestment.

Break-Even Analysis

Determine the revenue level required to cover all costs—this is your survival threshold.

3. Scenario Planning

What-If Analysis

Model scenarios such as losing a major client or increasing marketing spend.

Forecasting

Project future P&Ls based on realistic assumptions to support goal-setting and resource allocation.

4. Red Flags and Opportunities

- Consistent Losses: Temporary investment or structural issue?

- High Customer Concentration: Overreliance on one client increases risk.

- Expense Spikes: Investigate sudden or unexplained increases immediately.

Real-World Example: A Sole Proprietor’s P&L in Action

Example: Consulting Business (3-Month Snapshot)

Analysis

February’s dip in revenue and net profit may indicate seasonality or a lost client. March’s rebound suggests a new engagement or expanded project scope.

Action

Identify the cause of slower months and plan ahead by building cash reserves or adjusting workload strategies.

Using Your P&L for Tax and Compliance

Quarterly Reviews

Regular reviews help estimate taxes accurately and avoid year-end surprises.

Deduction Tracking

Ensure all allowable deductions are captured, including home office expenses, mileage, and supplies.

Audit Trail

A well-maintained P&L provides clear documentation in the event of an audit.

Leveraging a Bookkeeper: Beyond Data Entry

A professional bookkeeper can:

- Customize reports to highlight key performance indicators

- Identify trends and potential issues early

- Advise on best practices for margins and cash flow

- Implement cloud-based tools for real-time collaboration

Pro Tips for Sole Proprietors

- Automate Where Possible: Reduce errors and save time with accounting software

- Schedule Regular Reviews: Monthly reviews support proactive decision-making

- Benchmark Performance: Compare margins and ratios to industry standards

- Document Everything: Maintain organized digital records of receipts and invoices

Conclusion

Final Thoughts

A Profit and Loss statement is more than an accounting requirement—it’s a living document that tells the story of your business. The deeper you analyze it, the more clarity and control you gain. Use your P&L not just to report the past, but to actively shape your future.

Lastest blog posts

Contact us

Discover how we can simplify your bookkeeping, streamline your accounting, and help you make smarter financial decisions. Reach out today! We’re here to help you save time, reduce stress, and grow your business.